kentucky property tax calculator

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Please note that we can only estimate your property tax based on median property taxes in your area.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180. 103 of home value Yearly median tax in Kenton County The median property tax in Kenton County Kentucky is 1494 per year for a home worth the median value of 145200. Estimate Property Tax Our Allen County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

The average yearly property tax paid by Wolfe County residents amounts to about 111 of their yearly income. Our Meade County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. It is levied at six percent and shall be paid on every motor vehicle used in.

That is a 21915 difference between the average mortgage balance and the cost of a home in Kentucky. KRS 132220 1 a. Compare your rate to the Kentucky and US.

This calculator uses 2021 tax rates. Kenton County Kentucky Property Tax Go To Different County 149400 Avg. At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750.

This calculator will determine your tax amount by selecting the tax district and amount. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. Kentucky charges local occupational taxes on the county and city level.

Kentucky homeowners pay 1257 annually in property taxes. Counties in Kentucky collect an average of 072 of a propertys assesed fair. Estimate Property Tax Our Kenton County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

If you dont know your assessment value or tax district please look it up here using your address. Kentuckys median house value is 148400. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year.

Payment shall be made to the motor vehicle owners County Clerk. Overview of Kentucky Taxes. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator.

All rates are per 100. Wolfe County collects on average 054 of a propertys assessed fair market value as property tax. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation. The tax estimator above only includes a single 75 service fee. State Real Property Tax Rate.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. However these rates only apply to wages salaries and other forms of compensation for employees in the state. The median property tax in Wolfe County Kentucky is 293 per year for a home worth the median value of 54400.

Please note that this is an estimated amount. How high are property taxes in Kentucky. Mortgage payments vary depending on your down payment loan terms and interest rate as well as additional costs such as taxes.

Property tax is calculated based on your home value and the property tax rate. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts.

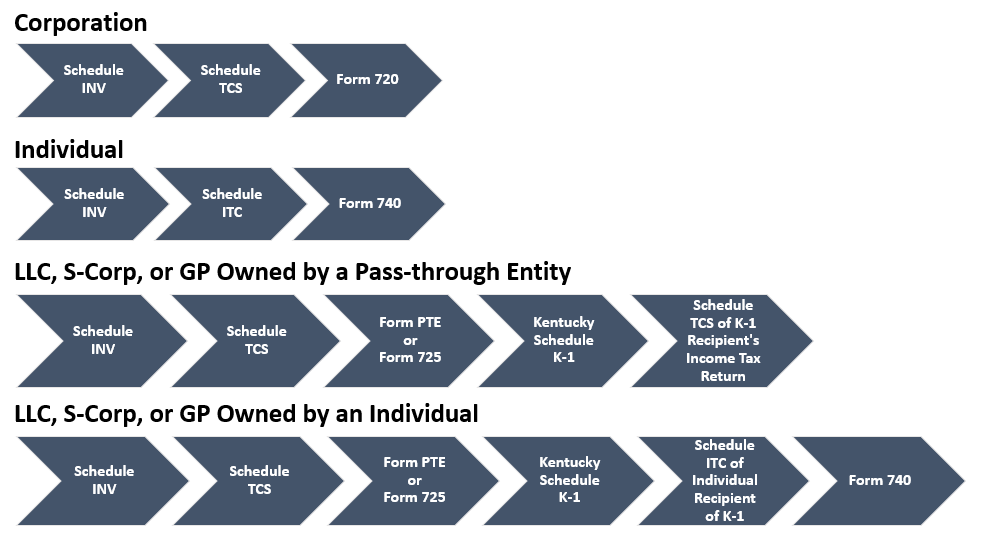

Yes I have. Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset. Therefore the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit.

072 of home value Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Therefore retirees will not be on the hook for these taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Shelby County.

Kentucky has a flat income tax of 5. Both sales and property taxes are below the national average. If you are receiving the homestead exemption your assessment will be reduced by 40500.

Actual amounts are subject to change based on tax rate changes. The median property tax on a 16950000 house is 177975 in the United States. Kenton County collects on average 103 of a propertys assessed fair market value as property tax.

Kentucky Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value. The median property tax on a 16950000 house is 122040 in Kentucky. State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous years assessment totals by more than 4.

DORs online inventory tax credit calculator has the capability to track numerous separate locations. Meanwhile the states average outstanding mortgage amount is 126485. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

That rate ranks slightly below the national average.

Kentucky Property Taxes By County 2022

Metros Where Homeowners Pay The Lowest And Highest Property Taxes

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Jefferson County Ky Property Tax Calculator Smartasset

Property Tax Calculator Casaplorer

Property Tax Rate Will Stay The Same City Of Covington Ky

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

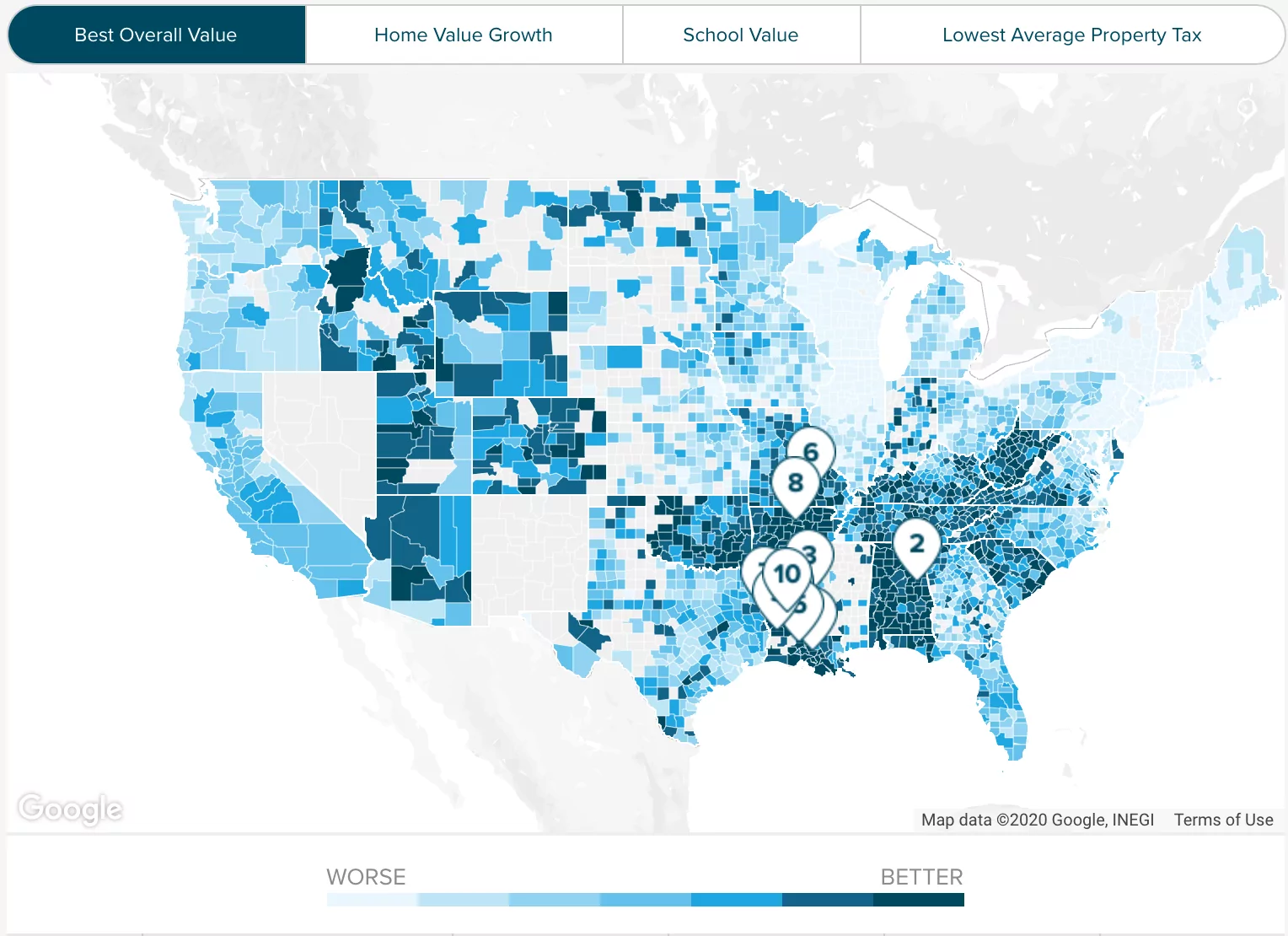

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Kentucky Property Tax Calculator Smartasset

North Central Illinois Economic Development Corporation Property Taxes

How Is Tax Liability Calculated Common Tax Questions Answered

States With Highest And Lowest Sales Tax Rates

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset